Embarking on a new financial commitment? A mortgage calculator can be your invaluable guide in navigating the nuances of repayment. This useful tool empowers you to estimate monthly payments, project total interest incurred over time, and analyze different financing terms. By employing a loan calculator, you can make savvy financial decisions that match your financial goals and enhance your overall financial health.

- Leverage a loan calculator to assess the effects of different interest rates.

- A loan calculator can reveal the advantages of making larger payments to minimize your debt.

- Consider a loan calculator as an integral part of your budgeting process.

Figure Out Your Loan Payments with Ease

Taking out a loan can be a big decision, and it's important to understand the consequences involved. One of the most crucial aspects is knowing exactly how much you'll have to pay back each month. Luckily, determining your loan payments doesn't have to be a difficult process. There are numerous tools and resources available that can make it quick and easy. You can use financial apps to input the loan amount, and they'll instantly generate a breakdown of your monthly payments, including principal. This way, you can make informed decisions and avoid any unforeseen expenses.

- Understanding your loan payment structure gives you control over your well-being

- Armed with this information, you can make better financial choices

LoanCalc : Get Accurate Loan Estimates Instantly

Tired of wading through confusing loan estimates? LoanCal is here to revolutionize your loan search experience. With our user-friendly platform, you can get accurate and personalized loan estimates in just a few moments. Whether you're looking for a mortgage, personal loan, or auto financing, LoanCal provides instant estimates based on your individual information. Our algorithm is designed to consider all relevant factors, ensuring you receive accurate loan estimates that match your unique needs.

- Get instant loan estimates for various loan types.

- Compare multiple lenders side-by-side.

- Save time and effort with a streamlined process.

Stop wondering about loan costs. Try LoanCal today and get the insight you here need to make informed financial decisions.

Simple & Robust Loan Calculators for All Needs

Navigating the world of loans can be challenging, but it doesn't have to be. With our selection of intuitive and powerful loan calculators, you can quickly and accurately estimate your monthly payments, overall interest, and other key loan factors. Whether you're researching a mortgage, auto loan, personal loan, or different type of financing, our calculators provide the resources you need to make smart financial decisions.

- Discover a wide range of loan calculator options tailored to your unique needs.

- Achieve transparent insights into your loan conditions.

- Make well-informed financial plans with confidence.

Navigating Loans Made Easy with Our Calculator

Are you keen about exploring the best loan options available to you? Our user-friendly loan calculator is here to clarify the process, providing you with reliable data at your command.

With just a few clicks, our calculator can estimate your monthly installments, aggregate cost and schedule terms. This allows you to contrast diverse loan scenarios and make an strategic selection.

- Initiate your quest to financial stability today!

Understanding Mortgage, Personal, Auto - Calculate Your Loan Options

Are you considering a major fiscal move? Whether you're hoping for a new home, needing funds for personal projects, or searching for a vehicle, understanding your loan options is crucial. Estimating your loan potential allows you to smart financial decisions and acquire the financing you need.

- For mortgages, variables including credit score, down payment, and interest rates have a major influence on your monthly payments and overall liability.

- Borrowing options for personal use can be helpful for financing home renovations, but weigh the implications of interest rates and repayment terms.

- Car payments depend on your chosen automobile, loan term, and credit history. Comparing different lenders and their offers can help you the best rates and payment plans.

Many online tools are available to calculate your loan eligibility and monthly payments. By understanding these factors, you can successfully tackle the world of loans and make sound financial choices.

Ralph Macchio Then & Now!

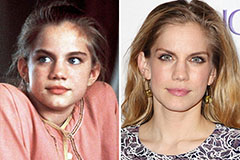

Ralph Macchio Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!